Cash pay or insurance? Find the right payment model for your practice

Running a therapy practice today comes with mounting challenges. Workforce burnout is on the rise as therapists juggle client care with time-consuming administrative tasks like insurance billing, compliance, and managing paperwork. Financial headaches from denied claims, slow payments, and cybersecurity threats only add to the stress.

Amid these pressures, many therapists are questioning whether to continue working with insurance or shift toward cash-pay clients—a decision that could reshape how they run their practice.

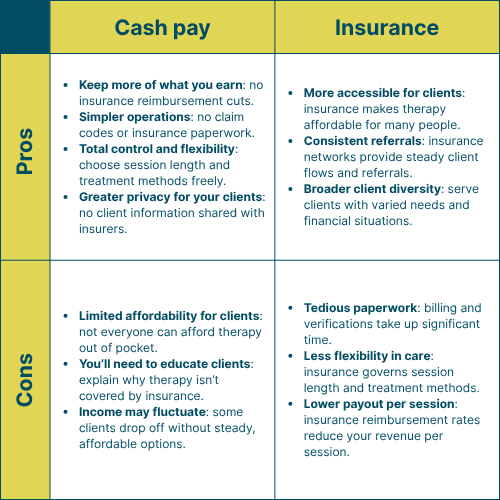

Cash pay vs. insurance clients: pros and cons for therapy practices

Let’s break down what’s good (and not so good) about both cash pay and insurance models for therapists.

Cash pay offers higher rates and less admin work, but it can also make care less accessible to certain clients. Insurance expands access but comes with lower reimbursements and more paperwork. A hybrid model combines the benefits of both, providing flexibility, stability, and broader accessibility.

Why a hybrid model makes sense now

So, why should you seriously consider combining both payment models? Here’s how a hybrid approach helps you thrive in uncertain times:

More stable, flexible income

Relying only on cash pay can shut out clients who need insurance, while taking only insurance can mean lower rates and more paperwork. Mixing both lets you stabilize cash flow, buffer against policy changes, and tailor your services to the needs of your market.

Boosted client access—without sacrificing revenue

You can maintain your commitment to affordability and inclusion by accepting insurance, especially for clients with limited means. At the same time, you retain the flexibility and financial upside of offering cash-based premium services to those willing or able to pay out of pocket.

Smarter, saner operations

With the right tools, you can automate routine admin tasks and carve out time for your clients—and yourself. Tech can help streamline insurance billing while keeping cash-pay systems simple. The result? Less time agonizing over paperwork and more time doing what you do best.

Built-in resilience for the future

As healthcare policies and reimbursement rules keep shifting, being able to flex between payment models prepares your practice for almost anything. If Medicaid or insurance rates drop, you’re not left scrambling; if cash clients dry up, you still have insurance clients keeping the lights on.

How to make a hybrid model work for you

- Be transparent about fees and policies: Publish your cash rates and list which insurance plans you accept. Make sure clients know their options—even before the intake call.

- Diversify your offerings: Consider group therapy, workshops, or extended sessions as cash-pay add-ons. You may reach new segments while boosting your earnings.

- Educate and set expectations early: Use intake materials, your website, and in-session discussions to spell out the benefits (and trade-offs) of both payment types.

- Make tech your friend: Invest in practice management software with reliable billing, credit card payments, scheduling, and telehealth features. Automation can help you avoid unnecessary errors.

- Review and adapt: Track which services fill up fastest, keep an eye on payer mix, and be ready to pivot as client demographics and regulations change.

Looking ahead

Adopting a hybrid payment model can give you the stability, flexibility, and client diversity you need to keep your business healthy—and keep your passion for therapy at the center of your work.

You don’t have to pick sides between cash pay and insurance. With a thoughtful hybrid approach, you’re building a practice that truly serves both your clients and your own goals. Ready to try something that actually works for you and your practice? Now might be the perfect time.